See This Report about Property By Helander Llc

See This Report about Property By Helander Llc

Blog Article

An Unbiased View of Property By Helander Llc

Table of ContentsLittle Known Facts About Property By Helander Llc.4 Simple Techniques For Property By Helander LlcThe Best Strategy To Use For Property By Helander LlcNot known Facts About Property By Helander LlcThe 8-Second Trick For Property By Helander LlcFacts About Property By Helander Llc Uncovered

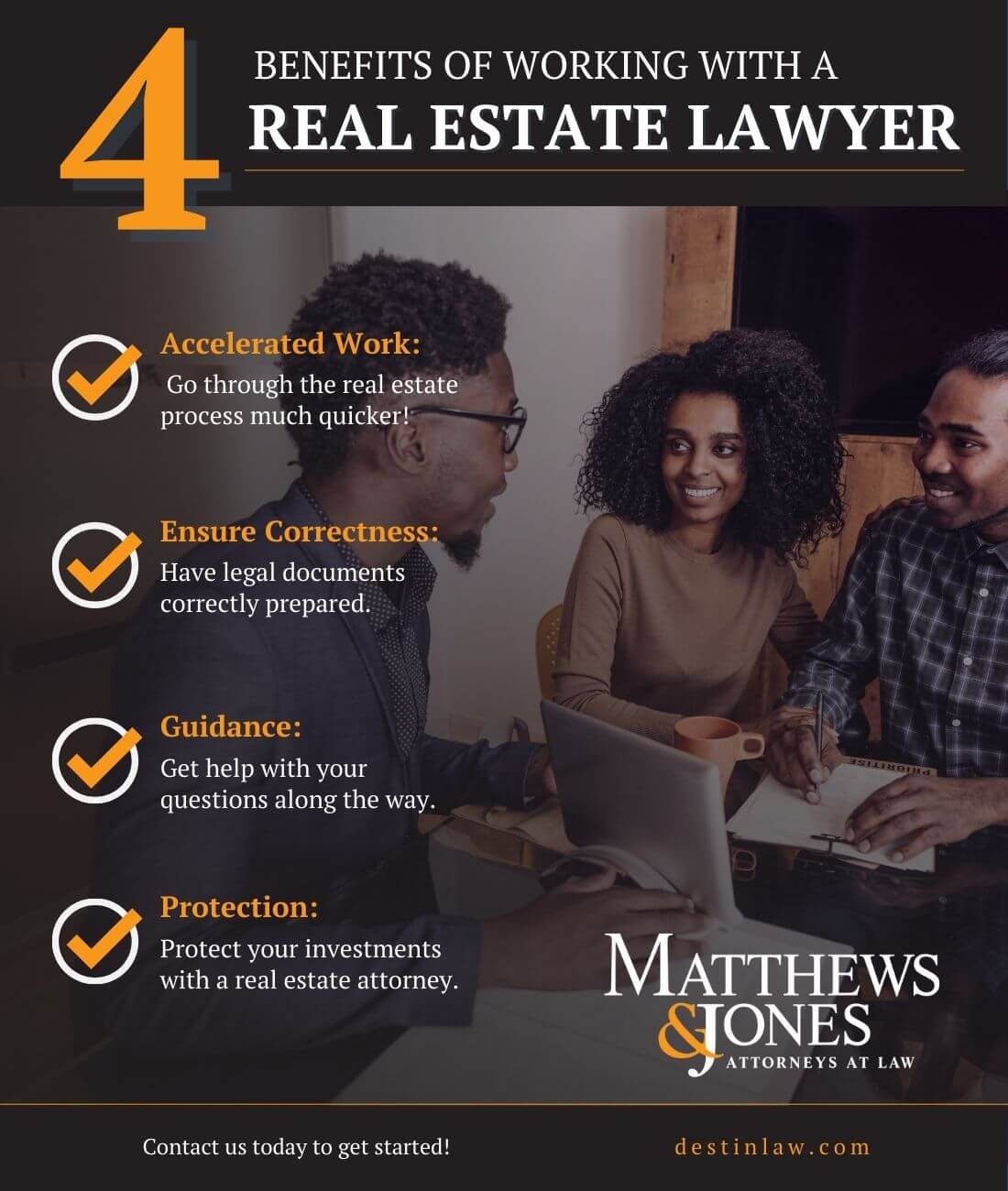

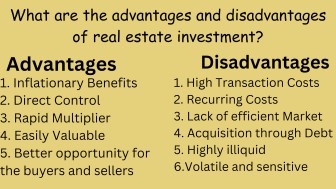

The benefits of purchasing property are numerous. With appropriate properties, investors can enjoy foreseeable capital, outstanding returns, tax obligation advantages, and diversificationand it's possible to utilize real estate to construct wide range. Thinking of purchasing realty? Below's what you require to find out about property benefits and why realty is considered a great financial investment.The advantages of investing in actual estate consist of passive revenue, steady cash money flow, tax obligation benefits, diversification, and utilize. Real estate financial investment depends on (REITs) supply a means to invest in genuine estate without having to possess, operate, or financing homes.

In a lot of cases, capital only strengthens with time as you pay down your mortgageand develop your equity. Genuine estate capitalists can make the most of various tax breaks and reductions that can save money at tax time. As a whole, you can deduct the sensible expenses of owning, operating, and handling a residential property.

Excitement About Property By Helander Llc

Property values often tend to enhance gradually, and with an excellent financial investment, you can transform an earnings when it's time to market. Rental fees likewise have a tendency to increase in time, which can lead to greater capital. This chart from the Federal Get Financial Institution of St. Louis reveals mean home rates in the united state

The areas shaded in grey indicate united state recessions. Typical Prices of Residences Marketed for the United States. As you pay down a property mortgage, you construct equityan property that becomes part of your total assets. And as you develop equity, you have the take advantage of to buy even more properties and enhance capital and riches a lot more.

Since real estate is a concrete asset and one that can offer as collateral, funding is readily offered. Real estate returns vary, depending on variables such as place, possession course, and administration.

Not known Incorrect Statements About Property By Helander Llc

This, subsequently, equates right into higher funding worths. As a result, real estate often tends to maintain the purchasing power of funding by passing several of the inflationary pressure on to occupants and by including some of the inflationary pressure in the form of capital admiration. Mortgage lending discrimination is unlawful. If you assume you have actually been victimized based upon race, faith, sex, marital standing, use public support, national origin, impairment, or age, there are actions you can take.

Indirect real estate investing entails find no direct possession of a building or homes. There are several means that possessing genuine estate can shield against inflation.

Finally, residential properties funded with a fixed-rate finance will certainly see the family member quantity of the monthly home loan settlements fall over time-- as an example $1,000 a month as a fixed payment will certainly become less burdensome as inflation deteriorates the acquiring power of that $1,000. Frequently, a key home is ruled out to be a real estate investment because it is made use of as one's home

Property By Helander Llc for Dummies

Despite having the aid of a broker, it can take a few weeks of job simply to discover the best counterparty. Still, realty is a distinctive asset class that's easy to understand and can enhance the risk-and-return account of a financier's profile. By itself, real estate offers cash money circulation, tax obligation breaks, equity building, affordable risk-adjusted returns, and a bush against rising cost of living.

Investing in property can be an unbelievably satisfying and profitable undertaking, however if you resemble a great deal of brand-new financiers, you may be asking yourself WHY you must be buying realty and what benefits it brings over other financial investment possibilities. In addition to all the fantastic benefits that go along with buying realty, there are some disadvantages you require to consider too.

Property By Helander Llc Fundamentals Explained

If you're trying to find a means to buy into the genuine estate market without needing to invest hundreds of thousands of dollars, have a look at our residential properties. At BuyProperly, we make use of a fractional possession version that allows investors to start with as low as $2500. One more major benefit of genuine estate investing is the capability to make a high return from purchasing, restoring, and marketing (a.k.a.

Property By Helander Llc Can Be Fun For Anyone

If you are billing $2,000 lease per month and you incurred $1,500 in tax-deductible expenses per month, you will only be paying tax obligation on that $500 revenue per month (Sandpoint Idaho land for sale). That's a huge distinction from paying tax obligations on $2,000 each month. The profit that you make on your rental unit for the year is taken into consideration rental income and will certainly be exhausted appropriately

Report this page